The U.S. real estate market suffers from a Goldilocks problem; some markets are too hot and some markets are too cold. Pinkston Property Investment Services (“PPIS”) works with domestic investors seeking a more favorable market to invest in than their home market. Many individuals have access to credit markets and the resources necessary to invest in property but lack good opportunities in their home market. PPIS works with such investors to acquire and manage property in Colorado.

The U.S. real estate market suffers from a Goldilocks problem; some markets are too hot and some markets are too cold. Pinkston Property Investment Services (“PPIS”) works with domestic investors seeking a more favorable market to invest in than their home market. Many individuals have access to credit markets and the resources necessary to invest in property but lack good opportunities in their home market. PPIS works with such investors to acquire and manage property in Colorado.

The New York Times clearly identified the problem investors face in markets that are too hot (e.g., New York and San Francisco).1 The competition for properties in those markets makes investing cost prohibitive and negates any potential return. PPIS allows investors from such markets to put their good credit scores to work and to engage in real estate investing in a more accessible market.

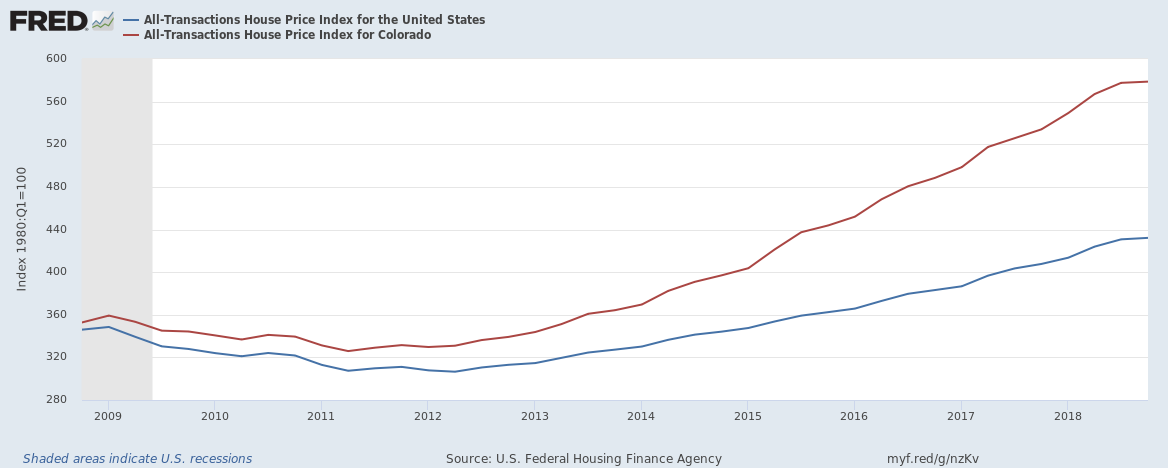

On the other end of the spectrum are people living in cities that are experiencing less robust economic growth and/or population decline. The true value in real estate investing comes from patiently investing in a consistently appreciating market. Without economic and population growth, property appreciation is very unlikely. Investors in these markets can easily access the domestic credit market and invest in a market that has substantially beaten the national average over the last 10 years.2

PPIS welcomes inquiries from financial advisers seeking alternative asset classes for their clients. Financial advisers should contact PPIS directly to learn how its services can help to diversify an investment portfolio.